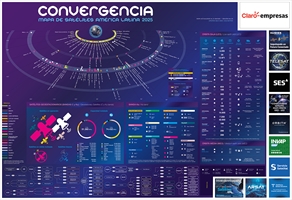

Satellite Map in Latin America 2025 - Credit: © 2025 Convergencialatina

The satellite industry is experiencing a marked expansion of low-earth orbit constellations, while the GEO market continues its concentration trend. GEO players are repositioning themselves as a result of the LEO craze—and MEO, with new activations of SES's O3b mPower—but also due to the boom in Direct-to-Device (D2D) testing.

New business models are emerging around the LEO fever—approaches with resellers, ISPs, and mobile operators—but also games tinged with geopolitics. The two offerings available today—Starlink and Eutelsat OneWeb—are now being followed by Amazon Kuiper, with 27 satellites already in orbit and a commitment to the US FCC to have half of the constellation (out of a total of 3,232) deployed by July 2026. The launch of Telesat Lightspeed is also planned for next year.

At the same time, other fleets with specific objectives are being planned, such as Sateliot, which received a €10 million investment from Hyperion for around 100 devices and a focus on IoT. And Outernet, from Rivada Space Networks, plans to launch into orbit by 2026 and begin offering services—primarily for large companies and governments—in 2027.

Both Europe and China are seeking their own place in LEO space, recognizing their specific weight in terms of technological leadership, economies of scale (locating factories on their territories, for example), and defense. The ongoing bidding wars in semiconductors and AI between the United States, Europe, and China are also reflected in the satellite world. China is participating in this competition through various initiatives: CASC, with 29 satellites already launched and 12,971 planned; Galaxy Space, with a total planned fleet of 1,000 devices; and Spacesail, with 72 current and 14,000 future launches. In December 2024, the European Commission signed a 12-year concession contract with SpaceRISE consortium to deploy and manage the Infrastructure for Resilience, Interconnectivity, and Security Satellite (IRIS2) system. This is a multi-orbital constellation (in MEO and LEO) of 290 satellites, also part of the European Space Strategy for Security and Defense and will cost approximately €10.6 billion. The SpaceRISE consortium is made up of three European satellite operators: SES, Eutelsat, and Hispasat.

Regarding MEO, the seventh and eighth satellites of SES's O3b mPower, launched in late 2024, came online in May 2025. This allows for a 30% increase in constellation capacity.

D2D is a clear player in the transformation of the satellite segment, in both its flavors. On the one hand, established mobile satellite service (MSS) operators are seeking to expand their offerings by adopting new 5G NTN (Non-Terrestrial Networks) standards for next-generation mobile devices. This includes Globalstar, a traditional player in the LEO segment with 24 satellites in orbit, which plans to expand its constellation as part of its D2D agreement with Apple. On the other hand, new entrants such as Starlink and AST Space Mobile are deploying large LEO constellations and aiming to repurpose mobile terrestrial spectrum, focusing on their existing customer base without any modifications or upgrades to these devices.