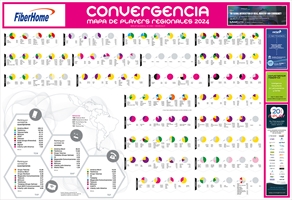

Regional Players Map in Latin America 2024 - Credit: © 2024 Convergencialatina

The search for sustainability for operations and the advancement of OTTs and hyperscale players motivated a tumultuous 2024 in terms of mergers and acquisitions in the Latin American telecommunications market. Beyond the interference of investment funds - a trend that continues -, Big Players are rearranging their footprint in the region.

América Móvil acquired control over ClaroVTR in Chile, reaching a 91.62% shareholding, while Liberty Latin America (LLA) retained the remaining 8.38%. With this move, the Mexican company's subsidiary became the leader in the Chilean fixed broadband market, approaching a 30% share, compared to Movistar's 28.79% (Subtel, as of September 2024).

LLA reduced its presence in Chile, but acquired 50% of the FTTH provider WOW in Peru. The incursion into that market was known at the end of 2024, although the investment - of US$ 100 million - dates back to 2021. WOW stands out for its progress in capturing the fiber market outside of Lima and Callao, even surpassing Telefónica: at the end of the third quarter of 2024, it leads the segment with 39.24% of connections (Osiptel).

On the other hand, LLA acquired EchoStar's spectrum assets (100 Mhz) in Puerto Rico and US Virgin Islands, as well as 85,000 prepaid mobile subscribers. And it announced the merger of its operation in Costa Rica with Millicom's own: this operation will be completed in mid-2025 and will culminate with Liberty holding an approximate 86% stake in the new company, and 14% for Millicom. The merger will give rise to an operator with 440,000 fixed broadband subscribers, approximately 40% of the market (Sutel).

In the case of Millicom, in addition to this movement in Costa Rica, it is evaluating strengthening its position in Colombia. In mid-2024, it formalized its intention to purchase Telefónica's shares in Coltel, and both companies signed a non-binding memorandum of understanding, establishing the bases for future negotiations. Millicom - which became controlled by Atlas Investissement, with 40.4% of the share package - is also exploring the possibility of keeping the part of Empresas Publicas de Medellín (EPM) in TigoUne (50% plus one share).

Both Colombia and Chile have an actor in bankruptcy, which also boosted token movements during 2024. WOM Chile filed for Chapter 11 protection in the United States in April, listing debts of more than US$1 billion, and weeks later it the same goes for the Colombian subsidiary. In any case, the Novartis subsidiary plans to exit Chapter 11 in mid-2025. In the case of Chile, América Móvil and Telefónica signed a non-binding agreement to jointly explore their participation in the process of selling WOM's assets.

Other piece movements in Latin America include the opening of the Internet market in Uruguay for cable operators - which, for example, led to the creation of Unired Digital, made up of the three central players of Montevideo, TCC, Nuevo Siglo and Montecable; the exit of Digicel from the Panamanian market, after the merger between +Móvil and Claro; and the integration of Izzi and Sky by Televisa in Mexico, after the company acquired AT%T's participation in the capital stock of Sky México.